Heights Finance: Account Creation, Benefits, And Drawbacks

Are you searching for the fastest loan company? Is heights finance trustworthy? Basically, it’s a financial services company. You can get the fastest loan service. This will provide you with quick services and easier loan applications as well. However, there are still some issues with this company. Do you have to trust them or not? However, it also provides loan services to people with bankruptcy or low credit scores.

Are you looking for easier installment loans? Therefore, in this article, we will give you a complete analysis of this company. It will include complete details and customer reviews. This will help you decide whether you should apply for this loan or not.

It’s a financial services company. So it’s important to know that currently it is only available in six states it is only available in six states. It is actually helpful for you to get loans. Usually, it focuses on providing loans even for people with bankruptcy cases. Moreover, you will find more competitive services here. A company’s status is actually determined by its user satisfaction. Some people have had good experiences with this leading company, while others face difficulties. However, most of the time they are facing issues with poor service and billing problems. There are multiple benefits to working with them. However, some negative points also exist here.

Company Profile

| Ownership status | Merged/Acquired |

| Parent company name | Curo financial technologies |

| Primary industry name | Consumer finance |

| Financing status of company | Formerly PE-Backed |

| Other industries of company | Financial services |

| Primary office location | United states |

| Primary office address | P.O. Box 1947 SC29602, Greenville |

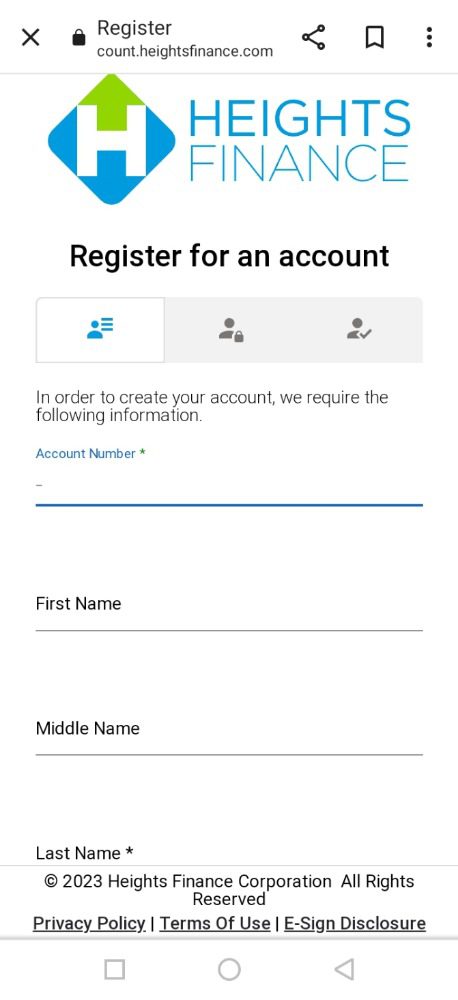

Account Creation And Setup On Heights Finance

Website detail: www.heightsfinance.com

First, you just need to open the website. Afterwards, you just need to fill in your personal details and then click on “processing. You can also click on the monthly payments option for returns.

What Are The Good Services Of Heights Finance?

Following are the good services or options that are available in heights finance:

- Secure loans

- Personal Minimum to Maximum Loan Amount

- Approval is available on the same day.

- 15-day guarantee

- Time in business

- Refer-a-Friend $50 Program

- Minimum credit score

- Online payments

1. Secure Loans

Through Heights Finance, you can avail of secure loans. It means you can easily pick up some collateral and easily avail yourself of good loan offers. The consumer’s loans are hence available on goods like cars. That’s why these are the best benefits of joining heights finance. However, it will make the process of funding easier for the people. People with limited funds and credit can easily take advantage of this opportunity. Moreover, it also decreases the chances of fraud.

2. Personal Minimum To Maximum Loan Amount

As a result, you can easily get personal loans. It offers you minimum and maximum loan amounts. Through Heights Finance, you can get a minimum loan of up to $500. However, it offers loans up to certain fixed amounts. Hence, if you’re looking for a huge loan amount, it might not be a good fit for you. Moreover, you can’t get loans over $10,000. It will be helpful for your personal growth.

3. Approval Is Available On The Same Day.

The best part of this company is its 1-day approval. So the processing of your application is easier with this. Now you don’t need to wait for so long to get money. That’s why, without any difficulties, you can easily avail the best funds as soon as possible. Moreover, you need to submit your application online. Right after submission, a representative will call you. This call will take between 24 and 48 hours. Hence, same-day approval is also available for certain days. It depends upon the time period of 24 to 48 hours for further application processing. For same-day approval, you have to make a call to Heights Finance.

4. A Guarantee Is Available For 15 Days.

These loans are available with a 15-day grantee option. As a result, you also have the option to refund the loan amount if you think about cancelling. Thus, a guarantee back feature is also open for you at the same time. Without any excessive fees or issues, you can easily cancel it too. However, you can get this feature of a free trial in case you change your mind. Furthermore, they will also return your payments if you make them through Heights Finance.

5. Time In Business

This company has actually existed for more than 24 years. That’s why we have a complete, secure platform for you. However, there is no assurance of quality. There is no doubt that it has existed for 24 years. Usually, most of the customers seem to be very happy due to their work and capacities. Most of them are usually happy with them. With these best credit-securing policies, it is easier and more reliable. However, most of the customers also suggest these, which have low financing. As a result, where other lenders do not lend money, they are available for so many people.

6. Refer-A-Friend $50 Program

There is a system that works best for all. If you refer a person to Heights Finance, you will get $50. However, there are no specific limitations on the number of referrals. Furthermore, you just have to print your referral card. Moreover, you have to give this card to someone at Heights Finance, and your loan processing will continue. Hence, your loan application can be easily submitted, and you can get the loan. Moreover, these types of referrals are actually easier and quicker.

7. Minimum Credit Score

Eventually, they will not disclose the minimum credit score. You don’t have to keep a specific balance in your accounts to avail of these loans. That means they are providing services to all the people, even those in bankruptcy.

8. Online Payments

You can see the processing and all application methods easily online. Whenever a person makes an account on the Heights Finance website, you can edit all the details. There, you just have to put the details of the payment methods. Furthermore, you can also add the date for the payments. Additionally, there is a single recurring payment option here. They can plan easily and automatically choose the months to return over their phones.

Overall Pros And Cons Of Heights Finance

Following are the pros and cons of joining and working in high finance.

Pros:

- They usually love to promote their employees.

- Moreover, the bonuses are great and easier to achieve.

- You will love to work with their team due to their support system.

- Most of the people’s reviews clarify that they are great people.

- It will encourage good team engagement.

Cons:

- Entry-level professionals are not getting better payouts.

- The upper management is not permanent. Hence, they will change from time to time.

- That’s why you might face problems dealing with new people each time.

- Long working hours for employees

- Ultimately, the turnover rates for the supervisors are actually very fast.

- Most of the field employees leave in less than a week. However, the reason behind it is usually due to the bad behavior of the team.

Online Application Availability

However, there are many branches and areas where this company is present. You can also choose to apply online. However, there are specific states that are only accepting online applications. These 3 states include;

- Kentucky

- Wisconsin

- Missouri

- Illinois

- Tennessee

Drawbacks Of Heights Finance

The following are the drawbacks of this company:

1. Only state existence

2. Availability of unknown terms and rates

3. Application limitations

4. Poor customer reviews

Only State Existence

Heights Finance is only available in six states. These are;

- Kentucky

- Tennessee

- Illinois

- Wisconsin

- Missouri

- Indiana

Availability Of Unknown Terms And Rates

This company only states the appropriate interest rates. However, they don’t disclose the exact amount of the annual interest rate. Moreover, it’s difficult to express what the loan bills will cost borrowers.

Application Limitations

Height’s Finance is only providing its services to specific states. Moreover, there are total of 100 branches available so far. After complete processing, the applications are directed towards the nearest branches. Afterwards, the team will contact you within 24 to 58 hours.

Poor Customer Reviews

When it comes to customer satisfaction, it’s not a good option for everyone. Most of the customers seem not to be very satisfied.

Top Alternative Companies

Following are the top alternative companies in financial services. You can approach them too. Firstly, you have to check out all the services in detail, and then you can choose them accordingly. These top companies are:

1. Best Egg

2. Regional finance

3. Upgrade

Frequently Asked Questions

Q. What does Heights Finance Corporation offer?

This company is actually offering real estate, home equity, personal, and other improvement loans.

Q. What is the return policy of Height’s Finance Company?

They make loans easier for all people. Their return policy consists of a monthly installment return process.

Q. In which states are heights finance companies available?

There are six states in which this loan company is present: Kentucky, Tennessee, Illinois, Wisconsin, Missouri, and Indiana.

Concluding Thoughts

Whenever you are looking for loan-provider companies, first of all, you need to check out their reviews. Height’s Finance is the company that provides easy installment loans. If you have faced any kind of bankruptcy or other case in the past, it will still provide you with a loan. However, there are also many drawbacks to this company. Most of its users don’t find it satisfactory. So you must consider some other good companies for obtaining loans if you are not satisfied.